Transitioning from Permanent to Contract Role in Life Sciences (1)

February 202610 min read

Boston’s Biotech Boom: Why Massachusetts Remains the World’s Leading Life Sciences Hub in 2026

Massachusetts continues to lead the U.S. biotech industry in 2026, with strong hiring demand, consistent investment, and one of the most active clinical pipelines in the country. The Boston–Cambridge cluster remains especially competitive, driven by experienced regulatory and clinical operations talent, a growing number of mid- and late-stage programs, and strong venture activity across key therapeutic areas.

Boston’s biotech sector remains the strongest in the United States in 2026. Massachusetts continues to outperform every other life sciences market, supported by deep scientific expertise, consistent investment, and a long history of research-driven innovation. The Boston metropolitan area, including Cambridge, Waltham, Watertown, Lexington and Worcester, still offers one of the most concentrated pools of biotech talent anywhere in the world.

For both candidates and employers, the result is a market that remains competitive, attractive, and full of long-term opportunity, even as hiring patterns soften compared with the rapid expansion earlier in the decade.

A Market That Has Evolved Rather Than Slowed

Boston’s biotech sector has continued to build on more than a decade of expansion, and the impact of that growth is still very visible across the region.

0+

People employed in Massachusetts Life Science sector

0%

Of all U.S. life sciences R&D roles are held in Boston-Cambridge

According to MassBioEd’s 2025 Workforce Report, life sciences employment in Massachusetts grew by just 0.03% in 2024. Hiring has clearly slowed from its post‑2020 highs, but the state still employs more than 143,000 people across the sector. That scale is unmatched by any other U.S. biotech hub.

Some functions have begun to level out. Research and development roles declined by 1.7% in 2024, and biomanufacturing roles fell by 1.5%, marking the first recorded drop in these categories. Job postings remain roughly 40% lower than during the surge in 2021. The story, however, is not one of contraction. Employers continue to report that it is difficult to hire experienced scientific, clinical, and regulatory talent. The pressure for high-value skills has not eased.

CBRE’s 2025 Life Sciences Talent Trends report reinforces Boston’s position at the top of the national talent landscape. The Boston–Cambridge cluster now represents nearly 13% of all U.S. life sciences R&D roles. Wage levels remain among the highest in the country, and the area has overtaken New York–New Jersey as the leading region for life sciences manufacturing talent. This reflects a shift toward more mature, mid‑stage and late‑stage companies that require experienced teams capable of delivering real progress.

Investment and Innovation in Massachusetts

Hiring may have stabilized, but Massachusetts companies continue to advance their pipelines. The Massachusetts Biotechnology Council (MassBio) 2025 Biopharma Funding & Pipeline Report shows that companies headquartered in the state grew their pipelines by nearly 14% year over year, far ahead of the national rate of 6.8%.

Funding remains solid, even as investors have become more selective. In 2025, Massachusetts companies completed 197 funding rounds, representing 26.2% of all U.S. biopharma venture capital. Notably, 60% of this investment arrived in the second half of the year, suggesting renewed confidence across the region.

Therapeutic priorities remain consistent. Oncology accounts for around a third of R&D activity, followed by central nervous system programs and anti-infectives.

Early 2026 data reinforces this trajectory. According to the Boston Business Journal, start-ups in the Boston area raised $1 billion in January 2026 alone, one of the strongest single-month totals in several years. This reflects both the depth of scientific activity across the region and the ability of Massachusetts companies to attract high-quality venture support.

The Skills That Continue to Shape Hiring in Massachusetts

Massachusetts benefits from a concentration of research institutions that few regions can match. The presence of MIT, Harvard, the Broad Institute and several of the highest NIH‑funded hospitals in the United States, has shaped the local talent market in very specific ways.

remains one of the most competitive functions for biotech and biopharma companies in Massachusetts. The region’s concentration of clinical‑stage programs means hiring teams prioritize candidates who can keep development on track and prevent delays at key milestones. Companies are looking for people who can:

- Lead submissions: Prepare and manage INDs, CTAs, and NDAs, coordinate responses to agency queries, and ensure documentation is complete and compliant on the first pass.

- Guide regulatory strategy: Advise on development pathways, label, safety considerations, and regulatory expectations across early‑ and late‑stage programs.

- Work across multiple regions: Support U.S. submissions while coordinating parallel activities in the EU, UK, and other major markets, particularly for companies building their first global strategy.

Candidates with experience in oncology, rare diseases, or advanced modalities such as cell and gene therapies remain in especially high demand across the Boston–Cambridge cluster. These programs often carry more complex CMC and safety considerations, making experienced regulatory talent crucial to progressing timelines smoothly.

Clinical operations continues to be one of the most consistent hiring areas across the state, largely driven by the number of Massachusetts‑based companies running Phase I–III studies simultaneously. Employers want candidates who can:

- Run trials end‑to‑end: Oversee Phase I–III studies from start‑up through close‑out, ensuring accuracy, compliance, and efficiency throughout.

- Manage CROs and sites effectively: Monitor vendor performance, resolve bottlenecks before they impact timelines, and maintain accountability across multiple partners.

- Solve operational issues quickly: Identify risks early, intervene before site problems escalate, and ensure patient recruitment and data collection remain on track.

Companies in Boston and Cambridge, in particular, value candidates who have operated within lean teams and can take responsibility for several studies at once. Experience working in fast‑paced biotech environments is a strong differentiator, especially where teams manage multiple therapeutic areas or run first‑in‑human trials.

As more Massachusetts companies advance assets into the clinic, program and project leadership roles have become essential. Organizations need people who can connect scientific, operational, and commercial planning across multiple programs. Typical hiring needs include:

- Program leaders: Oversee assets from preclinical to clinical stages, maintain accountability for milestones, and ensure each function understands deliverables and timelines.

- Project managers: Coordinate cross‑functional teams, track progress across CMC, clinical, regulatory, and research, and keep communication consistent.

- Portfolio and strategic operations: Support leadership with program prioritization, resource planning, and long‑term development strategy.

These roles are especially important in Boston–Cambridge, where many companies are running several clinical assets concurrently. Strong program leadership directly impacts how quickly companies can generate data, prepare submissions, and raise capital.

Alongside core R&D, companies across Massachusetts continue to hire for scientific roles that support development and clinical decision‑making. These include:

- Biomarker and translational specialists: Professionals who can link preclinical findings with clinical endpoints, guide assay development, and support patient‑selection strategies.

- Medical and scientific affairs: Individuals who can support publications, manage investigator relationships, and communicate scientific updates internally and externally.

- Quality and compliance talent: Experts who ensure GxP standards are met throughout development, especially as companies transition into later‑stage clinical or early manufacturing activities.

These positions remain challenging to fill because they require a balance of scientific expertise, operational judgment, and the ability to work effectively in smaller cross‑functional teams. Companies in Boston’s biotech sector often seek candidates who can support both strategic discussions and hands‑on execution.

For candidates, this combination of roles offers strong career progression opportunities. For employers, it underscores why Boston remains one of the most competitive markets for experienced scientific and development talent.

Salary trends and compensation in Boston biotech

Boston consistently ranks among the top U.S. markets for life sciences wages. Compensation remains highest for regulatory, clinical leadership, and experienced CMC professionals, reflecting the scarcity of talent in these areas. Many mid‑stage biotechs are also offering equity or long-term incentives to attract and retain key hires, making total rewards a major consideration for both candidates and employers.

Explore compensation trends for every key function.

Our latest Life Sciences Salary Guides break down current pay ranges across regulatory affairs, clinical operations, CMC, quality, R&D, and more. They are ideal for hiring managers planning headcount or for candidates benchmarking their next move.

What hiring looks like in Massachusetts biotech in 2026

Selective hiring is expected to continue. Employers are prioritizing candidates who can operate across multiple functions and bring deep technical expertise. Contract and interim roles remain common in clinical and regulatory areas, while biomanufacturing and quality hiring is increasingly tied to late-stage assets rather than early-stage R&D. Candidates with experience managing complex programs across multiple therapeutic areas will continue to have the strongest opportunities.

Boston: a market built for talent and development

For biotech and biopharma professionals, Boston offers one of the most active and rewarding career markets in the country. The region is home to close to 1,000 companies, ranging from global names such as Biogen, Shire, and Takeda to fast-growing start-ups working on first-in-class and best-in-class programs. Skilled candidates continue to benefit from a market where strong experience is recognized quickly and where opportunities span early discovery through late-stage development.

For employers, the environment is competitive and highly selective. Companies that succeed here tend to move quickly, communicate clearly, and offer compelling reasons for candidates to join their teams. Access to experienced leadership, proximity to academic research, and a concentration of development-stage programs all contribute to why so many organizations choose to scale in the Boston–Cambridge area.

This mix of opportunity, expertise, and infrastructure is what keeps Boston at the center of U.S. biotech and biopharma innovation. For professionals considering a move, the region offers a strong balance of career progression, academic and medical institutions, and a community built around scientific progress.

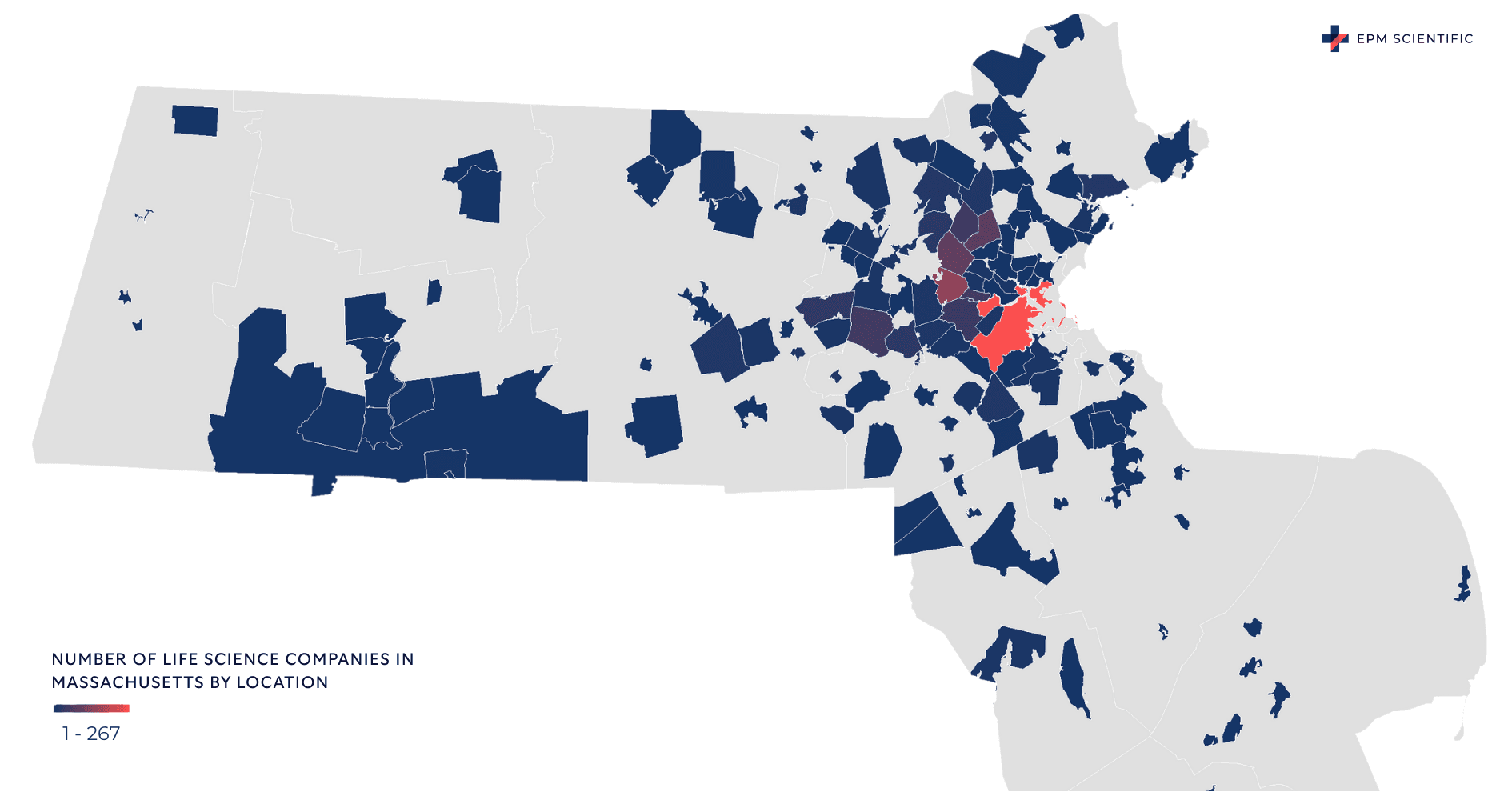

Mapping Massachusetts Biotech

To visualize the density and distribution of life sciences companies across the state, the map below highlights key hubs within Massachusetts, including Boston, Cambridge, Waltham, Watertown, Lexington, and Worcester. This overview provides a clear sense of where talent and opportunities are concentrated.

Image: Key biotech and biopharma hubs across Massachusetts, showing the concentration of companies driving life sciences innovation in Boston, Cambridge, Waltham, and surrounding areas. Data compiled from publicly available company information.

Supporting your next step in Boston’s biotech community

Whether you’re hiring or exploring new opportunities, having a partner who understands the market makes a real difference. As a specialist in biotech and biopharma recruitment, we work closely with companies and candidates across Massachusetts to match the right skills with the right roles.

For organisations, we help secure the regulatory, clinical and program talent needed to keep development moving. For candidates, we provide insight into the market, support through the hiring process and access to roles that align with their experience and ambitions.

If you’re planning your next move or building out a team, you can explore current openings across Massachusetts or speak with us about upcoming opportunities. Our goal is to help you navigate one of the most active biotech markets in the country with clarity and confidence.

FAQs: Boston & Massachusetts Biotech 2026

Massachusetts, particularly the Boston–Cambridge cluster, leads the U.S. biotech industry due to its concentration of research institutions, experienced talent, strong venture investment, and a dense pipeline of mid- and late-stage life sciences programs. The region accounts for nearly 13% of all U.S. life sciences R&D roles.

Regulatory affairs, clinical operations, program and project leadership, and development-adjacent scientific roles remain highly sought after. Candidates with experience in oncology, rare diseases, cell and gene therapies, or managing complex programs across multiple therapeutic areas have the strongest opportunities.

While overall hiring has stabilized since the post-2020 surge, selective recruitment continues. Employers prioritize candidates who can work across multiple functions, and contract or interim roles are common in clinical, regulatory, and biomanufacturing functions tied to late-stage asse

Boston consistently ranks among the top U.S. markets for life sciences salaries. Compensation is highest for regulatory, clinical leadership, and experienced CMC professionals, with many mid-stage companies offering equity or long-term incentives to attract and retain key talent.

Massachusetts biotech companies raised 197 funding rounds in 2025, representing over a quarter of all U.S. biopharma venture capital. Early 2026 data shows start-ups in the Boston area raised $1 billion in January alone, reflecting continued investor confidence and a strong pipeline of innovative programs.

The major hubs include Boston, Cambridge, Waltham, Watertown, Lexington, and Worcester. These areas host the highest concentration of life sciences companies, offering access to specialized talent, cutting-edge research, and investment opportunities.